According to data released by Canada, as many as 43.6 billion Canadian dollars flowed into Canada from Hong Kong last year, which shows that Hong Kong people have strong demand for Canadian banking services. Want to open a Canadian bank account? What are the options? Can I open an account in advance in Hong Kong?

Some Canadian banks can apply for the account opening in Hong Kong in advance, including the Bank of Montreal which has branches in Hong Kong.

According to data released by Canada, as many as 43.6 billion Canadian dollars flowed into Canada from Hong Kong last year, which shows that Hong Kong people have strong demand for Canadian banking services. Want to open a Canadian bank account? What are the options? Can I open an account in advance in Hong Kong?

Download the Yahoo Finance App

Free real-time quotes for U.S. stocks, foreign exchange, and cryptocurrencies, and get relevant news alerts for your own investment portfolio.

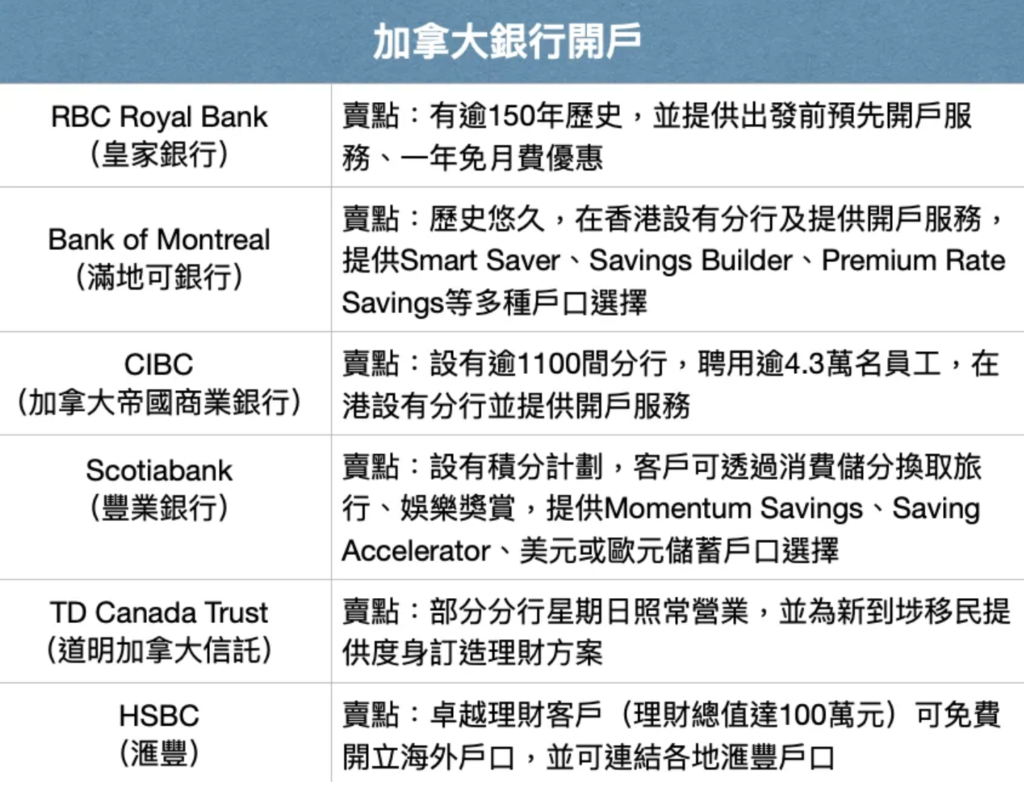

Six major bank choices

Hong Kong people generally choose one or two of the six major banks to open a bank account in Canada. The six major banks include RBC Royal Bank, Bank of Montreal, CIBC, Scotiabank, TD Canada Trust and HSBC.

Canada is a country that actively absorbs immigrants, so the six major banks provide financial services specifically for new immigrants, so as long as you have a valid identity and residence documents, you don’t really need to worry too much about applying for an account.

How to open a Canadian bank account

If you want to open an account before departure, you must consider a Canadian bank with a branch in Hong Kong. Both CIBC and Bank of Montreal have branches in Central to provide Hong Kong account opening services. Due to the epidemic situation, if you want to open an account at the two banks, you must first call the Hong Kong branch staff. The staff will usually ask you about your destination in Canada and the branch you will use when you arrive, and then submit the account opening form and documents via email. Immigrating to Canada to open an account must submit the passport photo page, residence visa and immigration paper (or the front and back of the Maple Leaf Card), and the completed account opening form. Generally, you will receive an account confirmation email in about three working days to one week.

After receiving the confirmation email, it is best to wire the funds to the Canadian account within one month. For wire transfer, fill in the account holder’s name, Canadian address, bank name, branch number, account number and branch address. After receiving the remittance, the bank will issue a deposit certificate for you to present to the customs for inspection when you enter the country. In addition, please note that this account can only be used for deposits. When you arrive in Canada, you must call the pre-selected branch to make an appointment, and bring your identification documents to the branch to complete the account opening procedure. Usually, you will apply for an ATM card or credit card by the way and complete the account activation procedure. The account can be used nationwide in Canada, as well as using banks mobile phones or online financial services.

Bank of Montreal

It is worth mentioning that the Bank of Montreal announced the sale of private banking services in Hong Kong and Singapore earlier, but this will not affect retail banking services in Hong Kong. Bank of Montreal can still be considered for opening an account in Hong Kong in advance. In addition, if the departure time is too long (for example, more than a year), the bank staff will usually advise you to wait, so friends who plan to leave next year may not need to open a Canadian account in Hong Kong urgently.

HSBC

If you want to seamlessly interoperate between your Hong Kong account and your Canadian account, you must consider another popular choice, HSBC. You can instigate immigration to Canada, and you can generally open an overseas account within a few working days. After opening an account, you will receive a new debit card and a new PIN code. After arriving in Canada, you will also have to present your identity and address proof documents at the branch to formally complete the application. The advantage of HSBC overseas account is to enter the login information to link to qualified accounts in different regions, including Hong Kong accounts. It is more convenient to manage Hong Kong and Canadian accounts.

RBC Royal Bank

As for RBC Royal Bank, it provides an online pre-account opening service. Fill in the information and submit the required supporting documents on the account opening page. After the account opening application is approved, you can also remit money to the bank’s Canadian account in advance by wire transfer.

Compare immigration discounts

If you want to open an account after arriving in Canada, you must pay attention to immigration discounts and services when choosing a border bank. Since Bank of Canada generally charges a monthly fee, basically the more diversified account services, the more expensive the monthly fee. However, in order to attract immigrants, banks will provide no fewer discounts, such as waiving monthly fees for the first year or opening an account with the whole family to enjoy more rebates or monthly fee reductions, so in addition to looking at the bank brand, you may also wish to compare the bank. Immigration benefits.

Another consideration is the service. For example, not many Hong Kong people will choose TD Canada Trust because of the longer business hours. For example, it opens at 8 o’clock in the morning, some days such as Wednesday, Thursday to 8 o’clock in the evening, and 8 on Sundays. Late Saturday, is very convenient for reworkers.

As for credit cards, it should also be noted that although new immigrants can issue cards, the upper limit is stricter, usually 500 to 1,000 Canadian dollars, which is not a big problem to cope with daily consumption, but you must work harder to clear the number of cards and keep staying. The quota is convenient for consumption.